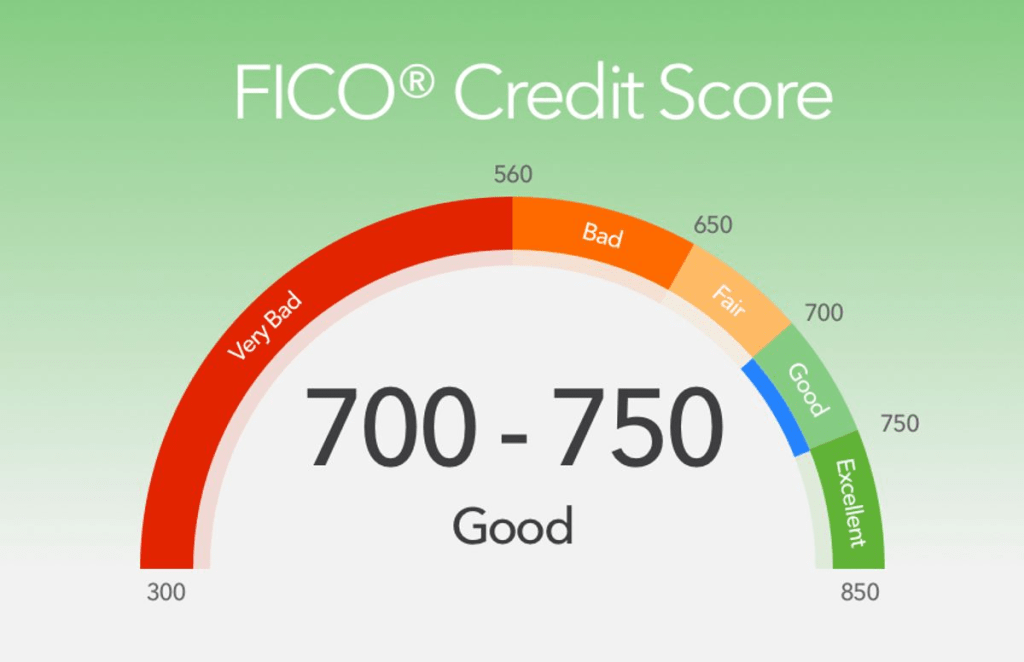

Your credit score plays a crucial role in many aspects of your financial life, including insurance premiums. Many insurance companies use credit-based insurance scores to assess risk and determine rates for auto, home, and even life insurance policies. A higher credit score can lead to lower premiums, while a poor score may result in higher costs.

Understanding how insurers use credit scores and what you can do to improve yours can help you secure better insurance rates and save money in the long run.

What is a Credit-Based Insurance Score?

A credit-based insurance score is a rating that insurance companies use to evaluate how likely a policyholder is to file a claim. While similar to a traditional credit score, it is specifically designed for insurance risk assessment.

Factors that influence your credit-based insurance score include payment history, where late or missed payments negatively impact your score. Credit utilization, or the percentage of available credit you are using, also plays a role, with lower usage leading to better scores. Length of credit history matters, as a longer credit history generally results in a higher score. The mix of credit accounts, such as credit cards, loans, and mortgages, can improve your score when diversified. New credit inquiries, particularly multiple recent applications, can temporarily lower your score.

Unlike a traditional FICO score, an insurance score does not consider income, job history, or marital status.

How Credit Scores Affect Insurance Rates

Insurance companies use credit-based scores to help determine premium costs, particularly for auto and home insurance. Studies have shown that individuals with lower credit scores are statistically more likely to file claims, leading insurers to charge them higher rates.

For auto insurance, drivers with poor credit scores may pay significantly higher premiums than those with excellent credit. Those with excellent credit (750+) typically pay between $1,200 and $1,500 annually, while those with poor credit (below 650) often pay $2,500 or more per year.

Home insurance premiums follow a similar pattern, with policyholders having excellent credit (750+) paying between $1,000 and $1,500 per year, whereas those with poor credit (below 650) often pay $2,500 or more.

Why Do Insurers Use Credit Scores?

Insurance companies use credit scores because data suggests a correlation between credit history and insurance claims. While not every person with poor credit files more claims, insurers use these scores as part of their overall risk assessment.

Lower credit scores are statistically linked to higher claim rates, leading insurers to classify applicants into different risk categories. Companies also use credit scores as part of their pricing models, grouping customers based on creditworthiness. Additionally, insurers may flag applicants with poor credit for potential fraud risks, using the data to detect inconsistencies in applications.

States That Restrict or Ban Credit-Based Insurance Scores

Some states have banned or restricted the use of credit-based insurance scores, arguing that it disproportionately affects low-income individuals.

California prohibits credit scores from being used to determine auto insurance rates. Hawaii and Massachusetts also ban the practice for auto insurance pricing, while Michigan has recently enacted similar restrictions.

If you live in one of these states, your credit score may not impact your insurance rates, but other factors like driving history and claims record will still be used.

How to Improve Your Credit Score and Lower Insurance Rates

Since credit scores play a major role in determining insurance premiums, improving your score can help reduce costs.

Paying bills on time is one of the most effective ways to improve your credit score, as late payments have a significant negative impact. Reducing credit card balances and keeping credit utilization below 30% of the available limit can also boost your score. Checking your credit report for errors and disputing incorrect information can lead to quick improvements. Limiting new credit applications prevents unnecessary credit inquiries that could lower your score. Maintaining a long credit history by keeping old accounts open helps establish financial stability.

Other Ways to Lower Insurance Costs Without Credit Score Changes

If improving your credit score takes time, consider other ways to reduce insurance premiums in the short term.

Shopping around for quotes from different insurers ensures that you get the best deal. Increasing your deductible can lower premiums, as higher deductibles reduce the amount insurers must pay for claims. Bundling auto and home insurance policies often leads to discounts. Asking about additional discounts, such as those for safe driving records, home security systems, or low mileage, can further reduce costs.

Conclusion

Your credit score has a significant impact on your insurance rates, especially for auto and home insurance. Insurance companies use credit-based insurance scores to assess risk and set premium rates, with higher scores leading to lower costs.

To reduce your insurance expenses, work on improving your credit score by paying bills on time, reducing debt, and maintaining good financial habits. Additionally, compare insurance providers, adjust your coverage, and take advantage of available discounts to maximize savings.

Frequently Asked Questions (FAQs)

Do all insurance companies use credit scores to determine rates? No, while most auto and home insurers use credit scores, some states have restrictions on this practice.

Will checking my own credit score affect my insurance rates? No, checking your own credit score is considered a soft inquiry and does not impact your credit rating.

How long does it take to improve my credit score for better insurance rates? It can take several months to a year to see significant improvements, depending on factors like payment history and debt levels.

Can I get auto insurance without a credit check? Yes, but options may be limited, and rates may be higher. Some insurers offer no-credit-check policies, but they often cost more.

What is the difference between a credit score and a credit-based insurance score? A credit score is used for loans and credit applications, while a credit-based insurance score is specifically used by insurers to assess risk.

Leave a comment