Having bad credit doesn’t mean you can’t qualify for a personal loan, but it does mean you’ll have to work harder to find the best rates, lowest fees, and most affordable repayment terms. Even with a low credit score, you can still get a good deal on a personal loan by exploring alternative lenders, improving your financial profile, and negotiating better terms.

What is Considered “Bad Credit”?

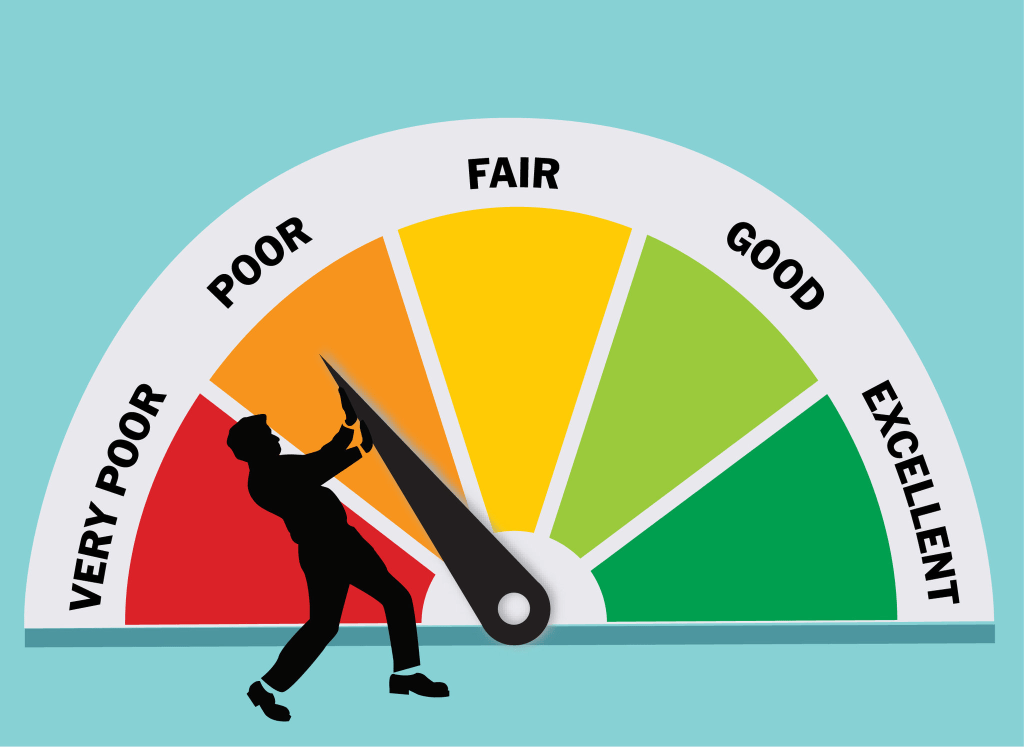

Lenders use credit scores to determine loan eligibility and interest rates. A lower score means higher risk, which often results in higher interest rates or loan denials. A credit score of 750 or higher is considered excellent, with approval chances being very high and interest rates ranging between 5% and 10%. Scores between 700 and 749 are classified as good, with APRs ranging from 9% to 14%. A score of 650 to 699 is fair, with moderate approval chances and interest rates between 14% and 19%. A credit score between 580 and 649 is considered poor, leading to lower approval chances and APRs from 19% to 36%. If your score falls below 580, your chances of approval are very low, with interest rates exceeding 36%.

If your credit score is below 650, you may need to explore alternative lenders or secured loans to improve approval chances.

Steps to Get a Personal Loan with Bad Credit

Checking your credit report for errors is the first step before applying. Free credit reports can be obtained from AnnualCreditReport.com, Credit Karma, Experian, or Equifax. Common mistakes to look for include incorrect late payments, fraudulent accounts, or misreported balances. If errors are found, disputing them with the credit bureaus can lead to a quick credit score boost.

Comparing lenders that accept bad credit is essential since not all lenders reject low-credit borrowers. Online lenders offer faster approval with flexible credit requirements but often charge higher interest rates. Credit unions provide lower rates and are more member-friendly but require membership. Peer-to-peer (P2P) lenders have a flexible approval process but offer varying rates. Secured loan providers offer better approval chances and lower rates but require collateral. Prequalifying with multiple lenders helps compare rates without affecting your credit score.

Considering a secured personal loan can increase approval odds and lower interest rates. Home equity loans and HELOCs allow borrowers to use their house as collateral. Auto title loans let applicants use their car title as security, while savings-secured loans require cash in a savings account. However, missing payments on secured loans puts your assets at risk.

Getting a co-signer with good credit can help secure approval and lower interest rates. Since co-signers are legally responsible for the loan if the borrower defaults, it’s important to choose someone who trusts you.

Improving your debt-to-income ratio (DTI) strengthens your loan application. DTI is calculated as (monthly debt payments ÷ monthly income) × 100. A DTI below 36% is excellent, while anything above 50% significantly lowers approval chances. Paying off small debts, avoiding new credit lines, and increasing income through side jobs can improve your DTI.

Choosing a shorter loan term can help secure a lower interest rate. While shorter terms reduce total interest paid, they may result in higher monthly payments.

Avoiding predatory lenders is critical. Red flags include extremely high interest rates above 36%, upfront fees before approval, and guaranteed approval without checking credit. Payday loans and cash advances often have APRs exceeding 200%, trapping borrowers in a cycle of debt.

Best Personal Loans for Bad Credit (2024)

Some of the best personal loan providers for bad credit include Upgrade, which requires a minimum credit score of 580 and offers loan amounts between $1,000 and $50,000 with APRs ranging from 8.49% to 35.99%. Upstart also accepts scores as low as 580 and provides similar loan amounts, with APRs starting at 6.70%. LendingClub requires a 600 credit score and offers loans from $1,000 to $40,000, with APRs ranging from 8.05% to 35.99%. OneMain Financial has no minimum credit score requirement, offering loans between $1,500 and $20,000 at APRs of 18.00% to 35.99%. Avant requires a 580 credit score, providing loan amounts of $2,000 to $35,000 with APRs between 9.95% and 35.99%.

Checking for prequalification before applying can prevent unnecessary hard credit inquiries.

How to Increase Your Credit Score Before Applying

If you can wait a few months before applying, boosting your credit score can lead to better loan terms. Paying off credit card balances reduces credit utilization, making all bill payments on time improves payment history, and disputing errors on your credit report can remove inaccurate negative marks. Using Experian Boost allows utility and rent payments to be added to your credit file, potentially increasing your score. Avoiding new credit inquiries before applying also helps maintain a stable credit profile.

Final Tips for Getting the Best Deal

Comparing at least three lenders ensures you find the lowest APR and most affordable repayment terms. Checking total loan costs, including fees, APR, and prepayment penalties, prevents unexpected expenses. Only borrowing what you need helps avoid unnecessary debt. Reading the fine print ensures there are no hidden charges.

Conclusion

Getting a personal loan with bad credit is possible, but it requires smart financial planning. Comparing lenders carefully, considering a secured loan or co-signer, improving your credit score and DTI, and avoiding payday loans and predatory lenders all increase your chances of securing a good deal. Taking the right steps can help you access the funds you need without falling into high-interest debt traps.

Frequently Asked Questions (FAQs)

What’s the easiest loan to get with bad credit? Secured personal loans, credit union loans, and online lenders offer better approval chances.

Can I get a personal loan with no credit check? Be cautious—no-credit-check loans often have high fees and interest rates, such as payday loans.

How fast can I get a bad credit personal loan? Some lenders approve and fund loans within 24 to 48 hours.

Does taking a personal loan hurt my credit? A hard inquiry may lower your score temporarily, but making on-time payments can improve it over time.

Leave a comment